In this post we will take a quick a look at when to buy a growth stock and when to sell it for short term trading with some examples.

Key indicators to follow:

- The market should be in an uptrend. In “ How to Make Money in Stocks: A Winning System in Good Times and Bad, by William O’Neil ”, Bill O’Neil has an excellent chapter, “M-Market Direction,” which does an excellent job of explaining how to detect the market uptrend.

- Look for the growth stocks that are bouncing from, or clearing resistance of, the 50 or 200 day moving average (DMA) support line. My article, “50/200 DMAs. What are they? Why I like them”, in a great resource for understanding these indicators more in depth.

- Look for the growth stocks that are clearing the three-week tight trading pattern. I explain more about this in my article “Three weeks tight. What is it? Why I like it”

Now, let’s walk through these with some examples using the recent uptrend.

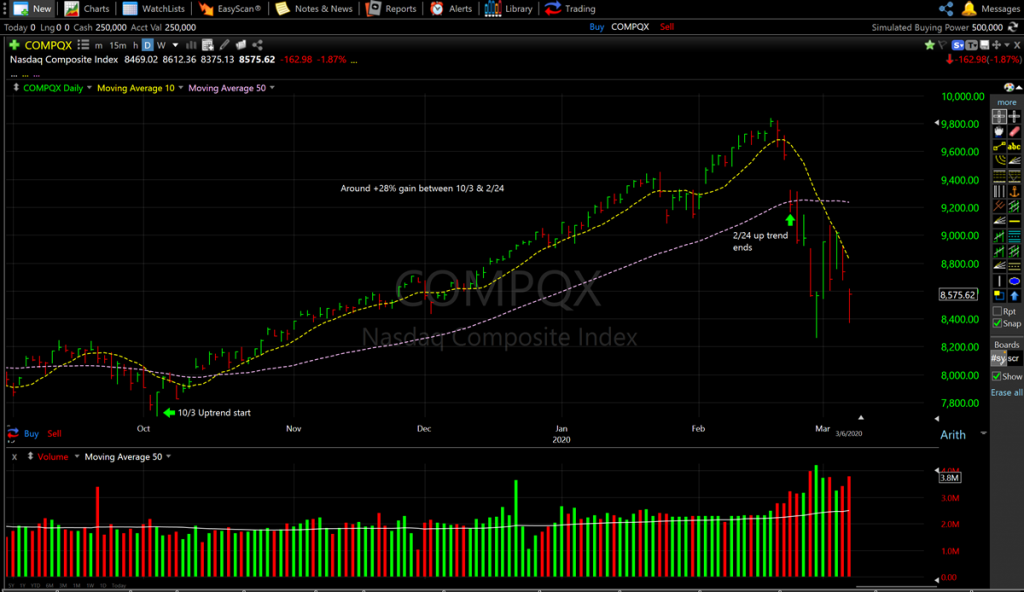

The recent uptrend ran between 10/3/2019 and 2/24/2020 and lasted about 20 weeks. The NASDAQ posted as much as +28% during this up trend. The Dow Jones and S&P 500 also posted rock solid gains. There were plenty of growth stocks breakeout after testing the 50/200 day moving average support line or clearing the three weeks tight pattern and yielded a great return.

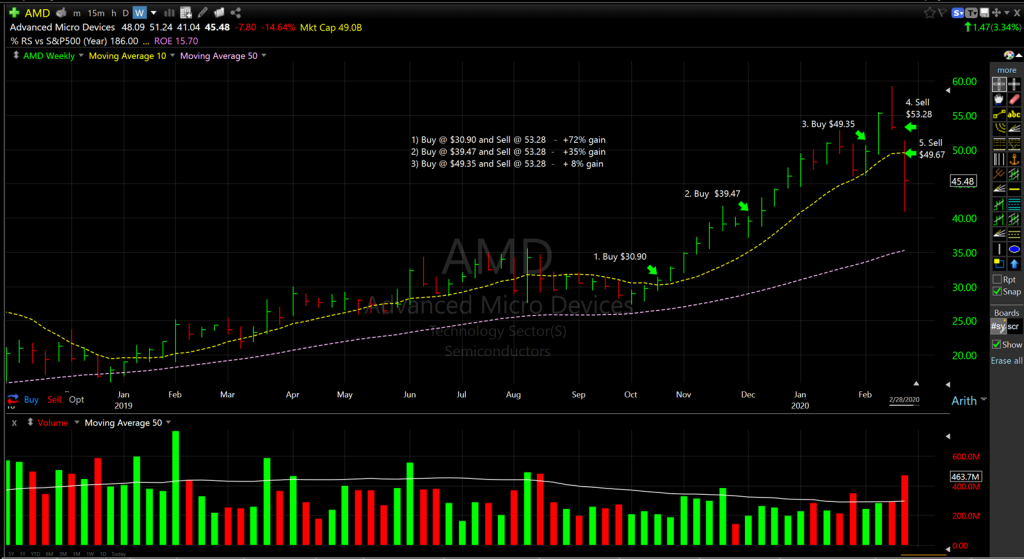

- Advance Micro Devices Inc., ($AMD) – The stock cleared the buy point $30.90 in the week of 10/19/2019 after regaining the 50 day moving average. The stock posted as much as +72% gain during this up trend before starting the downward move. The stock also offered multiple secondary entry points during the run.

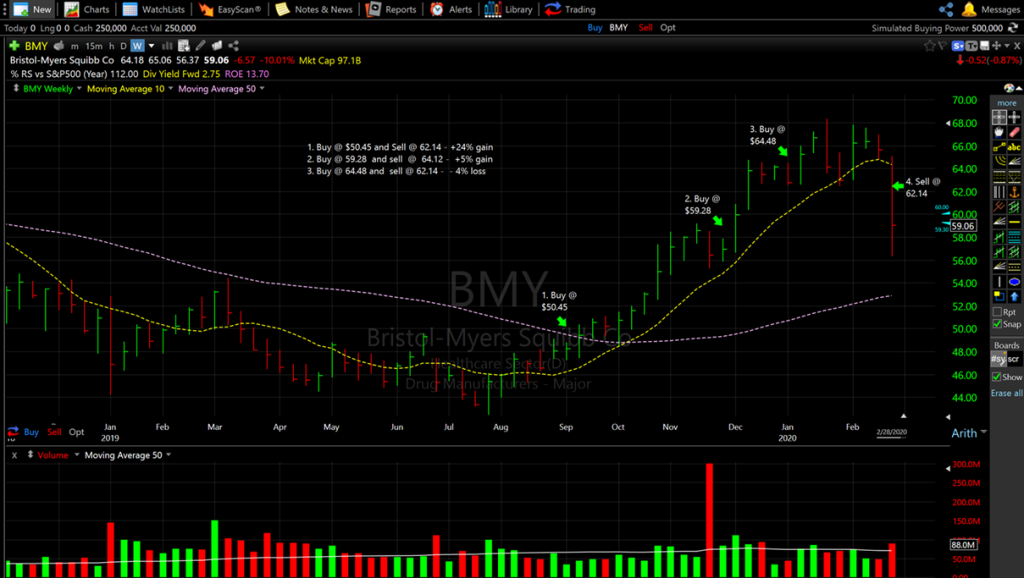

2. Bristol-Myers Squibb Company ($BMY)– The stock cleared the buy point $50.45 in the week of 9/13/2019 after regaining the 50 day moving average. The stock posted as much as +24% gain during this up trend before starting the downward move. The stock also offered multiple secondary entry points during the run.

3. Tesla Inc., ($TSLA) – The stock cleared the buy point $358.39 in the week of 12/20/2019 after tightly trading for many weeks. The stock posted as much as +109% gain during this up trend before starting the downward move.

So, below are the simple sell rules to follow once you take a position on a growth stock. Sell the stock when:

- Anytime it posts a -8% loss from your purchased price.

- It doesn’t post 5% gain within 3 weeks from the date you bought.

- It doesn’t post 20% gain within 12 weeks from the date you bought.

If the stock doesn’t meet the above sell rules, consider keeping it longer and let the profit run. Again, these are just guidelines, please use your own judgement and guidelines.