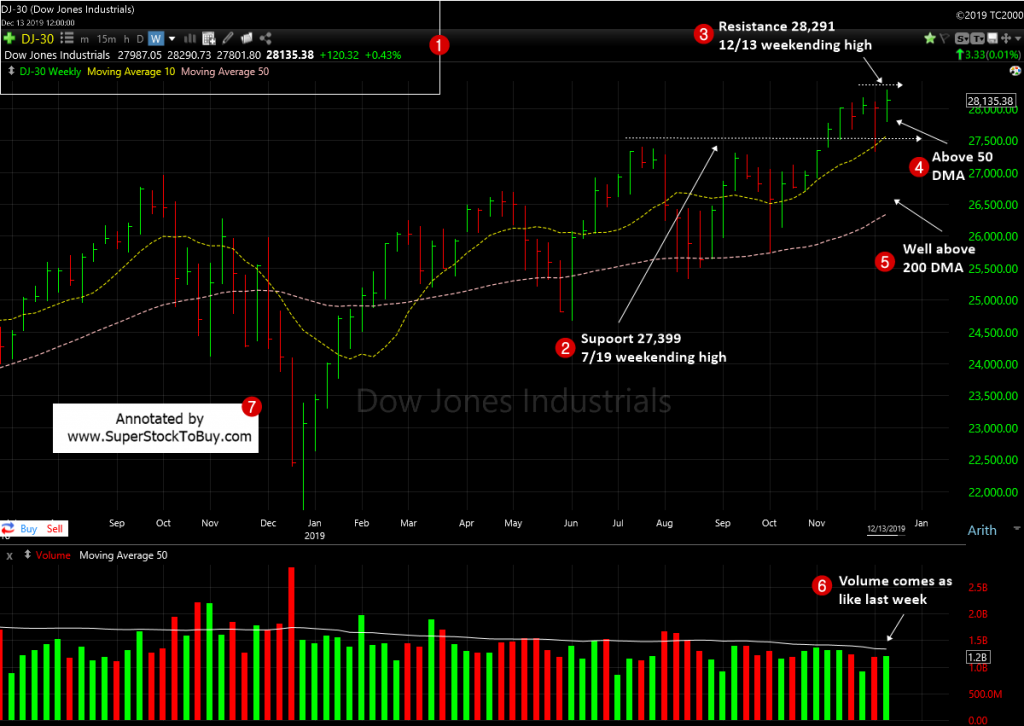

Dow Jones Industrial Average (DJIA) – Let’s look at the index’s key support and resistance analysis for the week of December, 20, 2019, using the weekly chart.

2. As the index posted decent gains, the support moved to 27,775 which is the 11/8 weekending high.

3. As the index made a new high, but closed below it, the resistance changed to 28,609 which is 12/20 weekending high.

4. The index continues to trade well above the short term 50 day moving average (DMA) support line.

5. It continues to trade well above the 200 DMA, the long-term support line.

6. The volume came in heavier for the week. Though the index gave up some gains on Friday, as the volume swelled, it doesn’t look that bad in the weekly chart, as it reduces the day in/out noise.

So, the index had over all nice week, and closed at the upper half/middle even though it gave up some intraday gains on Friday.

The gains at NASDAQ and S&P 500 were solid and outperformed the Dow. Both closed almost at top end for the week. The NASDAQ even posted over 2% gain.

So, the line of least resistance remains upwards and indices are moving up slowly, but steadily. So, just follow the trend until the zero hour arrives to change the course.

Around 144+ stocks posting over 5% gains in the Top Gainers – Growth Stocks Picks, as of this week.

Also do not forget to checkout the Stock Charts Gallery of annotated growth stock charts.

Snapshot of indices performance since 10/4 lows.

| Start | End | Diff(%) | |

| Dow | 25,743.46 | 28,455.09 | 10.53 |

| NASDAQ | 7,700.00 | 8,924.96 | 15.91 |

| S&P 500 | 2,855.94 | 3,221.22 | 12.79 |

Previous week chart: